Subsequent Event Disclosure Sample

Subsequent Event Disclosure Sample - For the purposes of isa 560, subsequent events are those events that occur between the reporting date and the date of approval of the financial statements and the signing of the auditor’s report. Web nonrecognized subsequent events (see fsp 28.6) are considered for disclosure based on their nature to keep the financial statements from being misleading. An organization’s management team is responsible for identifying and evaluating the events to determine if they have a material impact on the financial statements. Web show/hide news and events menu items. The financial statements, such as cutoff procedures or procedures in relation to subsequent receipts of accounts receivable). Web some examples of adjusting events are:

PPT Subsequent Event PowerPoint Presentation, free download ID527642

PPT Subsequent Event PowerPoint Presentation, free download ID527642

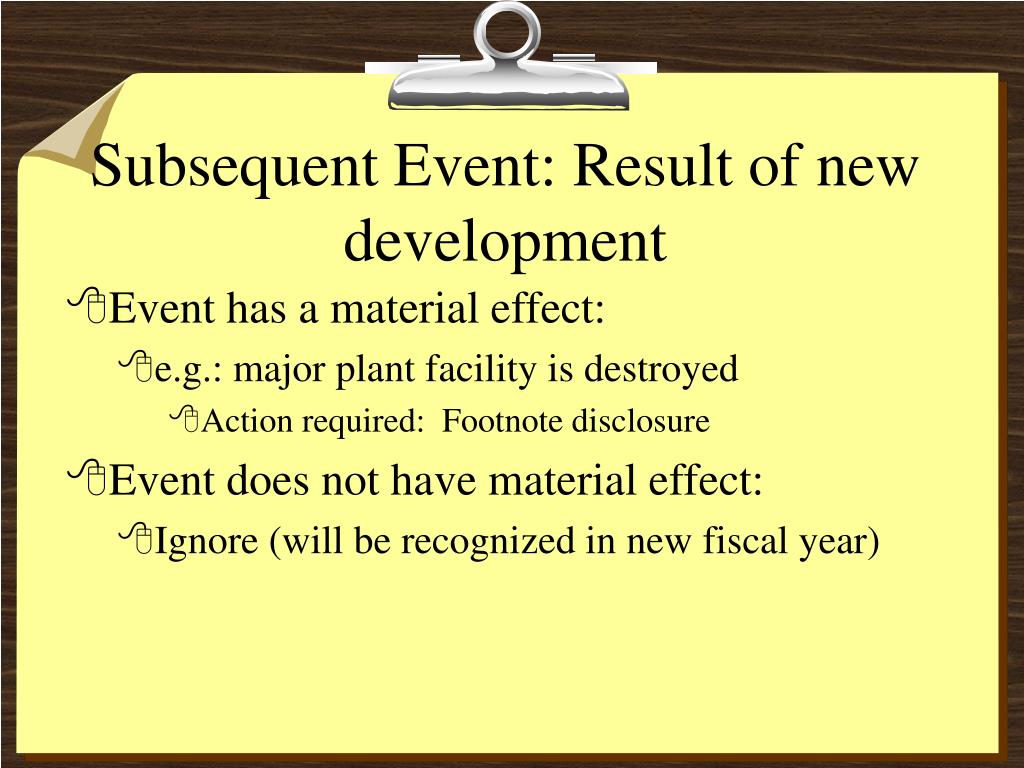

Subsequent events are events that occur between the balance sheet date and the date of financial statement issuance. Web show/hide news and events menu items. An organization’s management team is responsible for identifying and evaluating the events to determine if they have a material impact on the financial statements. Web.06 examples of events of the second type that require disclosure to the financial statements (but should not result in adjustment) are: Web the term “subsequent events” is used to refer to both events occurring between period end and the date of the auditor’s report, and facts discovered after the date of the auditor’s report.

Web Subsequent Events 163 Accounting Policies 164 43.

Web some examples of adjusting events are: Preparers need to consider the. Definitions 3 the following terms are used in this standard with the meanings specified: Asis of measurement b 160 44.

The Objective Of This Standard Is To Prescribe:

An example is a natural disaster that destroys a facility after the balance sheet date. It does not deal with matters relating to the auditor’s responsibilities for other information obtained after the date of the auditor’s report, which are addressed in hksa 720 (revised. Although these estimates are based on management’s best knowledge of current events and actions, actual results may ultimately differ from those. Basis of measurement 164 44.

Web The Following Is An Example Of A Typical Disclosure Of A Subsequent Event:

The auditor should consider the effect of subsequent events on the financial statements and on the auditor’s report. Because asc 855 does not provide any bright line tests for determining which subsequent events require disclosure, the decision regarding when to disclose a subsequent event is based on specific facts and circumstances and requires judgment. The settlement of a court case after the balance sheet date which confirms that an entity had a present obligation at the balance sheet date. Us financial statement presentation guide.

Web Isa 560, Subsequent Events Outlines The Auditor’s Responsibility In Relation To Subsequent Events.

Web.06 examples of events of the second type that require disclosure to the financial statements (but should not result in adjustment) are: In some cases, law or regulation also identifies the point in the financial statement reporting process at which the audit is expected to be complete. The financial statements, such as cutoff procedures or procedures in relation to subsequent receipts of accounts receivable). Subsequent events are events that occur between the balance sheet date and the date of financial statement issuance.

Events after the reporting period are those events, favourable and unfavourable, that occur between the end of the reporting period and the date. Subsequent events are events that occur between the balance sheet date and the date of financial statement issuance. Use of these sample disclosures the sample disclosures in this document reflect accounting and disclosure requirements outlined in sec regulation. Web isa 560, subsequent events outlines the auditor’s responsibility in relation to subsequent events. Web nonrecognized subsequent events (see fsp 28.6) are considered for disclosure based on their nature to keep the financial statements from being misleading.