Schedule B Form 941 Instructions

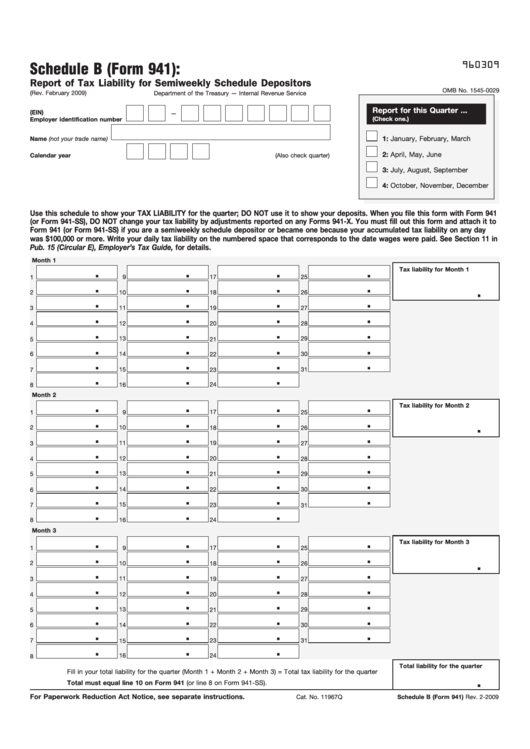

Schedule B Form 941 Instructions - June 2020) use with the january 2017 revision of schedule b (form 941) report of tax liability for. Web draft instructions for schedule b for form 941 were released feb. What is irs form 941 schedule b? These instructions tell you about schedule b. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web department of the treasury.

The instructions for schedule b have been updated to. Web the finalized versions of the 2021 form 941 and its instructions, as well as the revised instructions for form 941’s schedule b and schedule r, were released. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web the irs expects that this version of the form (rev. To determine if you are a.

The Draft Makes Changes To The Revised Guidance For.

Web updated schedule b instructions were released. How to file schedule b with form. Employers are required to withhold a. Web the finalized versions of the 2021 form 941 and its instructions, as well as the revised instructions for form 941’s schedule b and schedule r, were released.

Web Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, If You Defer Social Security Tax And Subsequently Pay Or Deposit That Deferred Amount In

Here’s a simple tax guide to help you understand form 941 schedule b. Why should you file form 941 schedule b? To determine if you are a. These instructions tell you about schedule b, report of tax liability for semiweekly schedule depositors.

March 2023) Will Be Used For All Four Quarters In 2023.

These instructions tell you about schedule b. Web the irs expects that this version of the form (rev. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Enter your business name, ein, and address.

Who Must File Form 941 Schedule B?

What is irs form 941 schedule b? Check the quarter box for which you’re filing the return. Web draft instructions for schedule b for form 941 were released feb. Web purpose of schedule b (form 941) these instructions tell you about schedule b (form 941), report of tax liability for semiweekly schedule depositors.

Enter your business name, ein, and address. Web schedule b (form 941), report of tax liability for semiweekly schedule depositors, if you defer social security tax and subsequently pay or deposit that deferred amount in Why should you file form 941 schedule b? June 2020) use with the january 2017 revision of schedule b (form 941) report of tax liability for. Web purpose of schedule b (form 941) these instructions tell you about schedule b (form 941), report of tax liability for semiweekly schedule depositors.