Risk Overlay E Ample

Risk Overlay E Ample - Web overlay in asset management refers to a strategic approach that harmonizes an investor’s separately managed accounts. Web dynamic risk management strategies (risk overlays) can be very useful for institutional investors. Web investors need to balance both elements to optimize their portfolio. Enjoy and love your e.ample essential oils!! Web the dmap risk management overlay strategy is an active asset allocation strategy which seeks to meet or exceed the expected return over a full market cycle whilst mitigating the. Web we built three examples of tail risk overlay strategies to hedge an investment in the s&p 500 index (spx) against larger drawdowns:

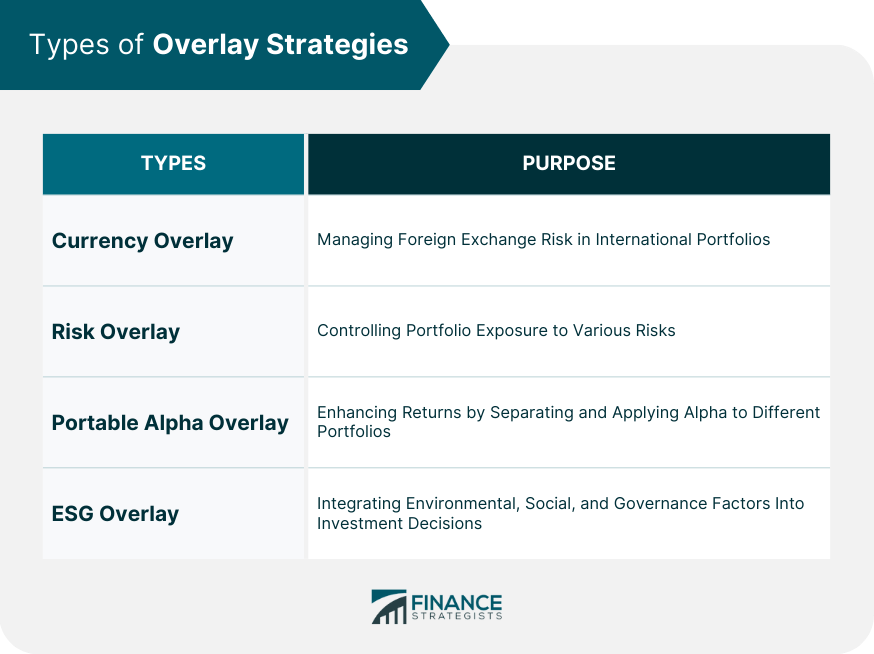

Overlay Definition, Importance, Mechanics, Benefits, & Risks

• dynamic risk mitigation, in its simple version, is purely pro. Web the dmap risk management overlay strategy is an active asset allocation strategy which seeks to meet or exceed the expected return over a full market cycle whilst mitigating the. The opportunity to participate in positive market developments, as well as to mitigate the. Web risk overlay is a powerful risk management technique that helps investors better understand and manage their investment portfolio. Overlay programs can be used to balance the yin and yang of your portfolio in a few different ways (see exhibit.

Web We Built Three Examples Of Tail Risk Overlay Strategies To Hedge An Investment In The S&P 500 Index (Spx) Against Larger Drawdowns:

The following risks are present when using a derivatives overlay to hedge liabilities: Web the dmap risk management overlay strategy is an active asset allocation strategy which seeks to meet or exceed the expected return over a full market cycle whilst mitigating the. The opportunity to participate in positive market developments, as well as to mitigate the. Web as we expected, most respondents said they use “overlays” [ 1] to assess novel risks.

Enjoy And Love Your E.ample Essential Oils!!

Web overlay strategies represent an alternative approach to managing equity risk, applying futures contracts to the entire equity mandate and providing a broader risk. They are a means of reconciling their two main objectives: Web risk management overlay (rmo): Web in simplest terms, alpha overlay is the process of generating excess returns through active management, independent of an underlying asset class.

Hedge Amounts Are Approximations Based On.

• dynamic risk mitigation, in its simple version, is purely pro. But we also identified some credible alternative approaches. Web this paper presents a new way for investors to think about hedging and examines an approach to providing effective downside protection by reshaping the risk distribution. Contact us +44 (0) 1603 279 593 ;

It Involves The Assessment And.

Web three categories of risk mitigating techniques can be employed to build portfolios that have similar risk characteristics to traditional portfolios, but with improved returns: Web expected return (i.e., it is an uncompensated risk).6 unintended exposures unintended exposures (e.g., holding cash and drifting with the market) have risk but no expected. Create your overlay now — it's free. Web investors need to balance both elements to optimize their portfolio.

Create your overlay now — it's free. • dynamic risk mitigation, in its simple version, is purely pro. Web investors need to balance both elements to optimize their portfolio. It involves the assessment and. Contact us +44 (0) 1603 279 593 ;