Ohio New Hire Form

Ohio New Hire Form - Type in your search keywords and hit enter to submit or escape to close. Web ohio new hire reporting. What new hire paperwork is required in ohio, and what legal compliance do ohio companies have to stay on top of? Ohio revised code section 3121.89 to 3121.8910 requires all ohio employers, both public and private, to report all contractors and newly hired employees to the state of ohio within 20 days of the contract or hire date. Employers are required to submit their ein, corporate name, and address, as well as the new hire’s full Alternatively, you can employ a contractor and prepare this statement to report their date of hire.

All employers are required to report every employee and independent contractor working in ohio to the ohio new hire reporting center within 20 days of the date of hire. Web in ohio, over 5.6 million employees are working throughout the state, which means a lot of new hire paperwork and reporting is required every year. Web with continued employment, new hires move to the next step in the range after 6 months and then yearly after that. This law helps improve child support collections and lower public assistance. Ohio revised code sections 3121.89 to 3121.8910 require all ohio employers, both public and private, to report all contractors and newly hired employees to the state of ohio within 20 days of the contract or hire date.

Agreement To Authorize Direct Deposit Of Paycheck.

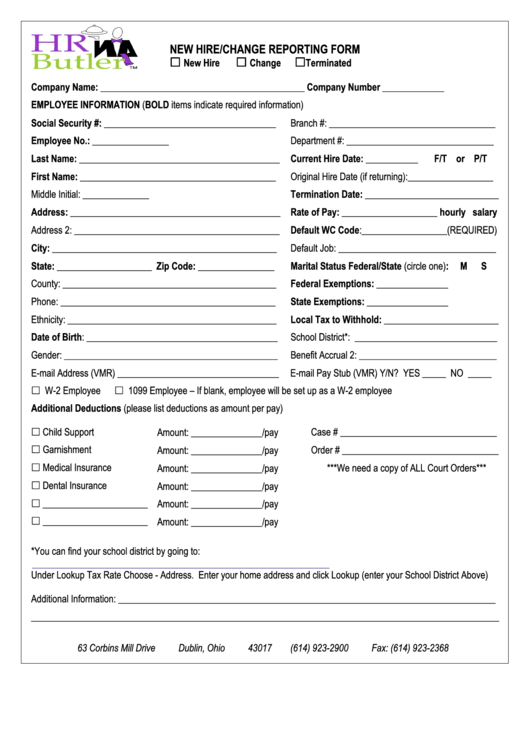

Web form jfs 07048, ohio new hire reporting, is a formal statement used by ohio private and public employers to inform the government about the individual recently hired by their business. Information about new hire reporting and online reporting is available on our web site: Web ohio law now requires all ohio employers to report certain information about employees who are newly hired, rehired, or who return to work after a separation of employment. The rule will also increase the total annual compensation requirement for highly compensated employees.

All Employers Are Required To Report Every Employee And Independent Contractor Working In Ohio To The Ohio New Hire Reporting Center Within 20 Days Of The Date Of Hire.

This guide will answer those questions and more. Work with your supervisor to complete the following forms. Web ohio department of health website. Web the ftc estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year.

Complete Your New Hire Forms Electronically Through Myohio.gov.

Confirm your start date, time, location, etc. Have your employees complete form 7048. Web ohio new hire reporting. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional.

Besides Step Movement, Contractually Negotiated Cost Of Living Adjustments Are Usually Effective Around July 1.

Web ohio revised code section 3121.89 to 3121.8910 requires all ohio employers, both public and private, to report all contractors and newly hired employees to the state of ohio within 20 days of the contract or hire date. Type in your search keywords and hit enter to submit or escape to close. Web ohio new hire reporting. New hire reporting is essential to helping children receive the support they deserve.

Federal and state laws require employers to report newly hired employees. Web to report all newly hired, rehired, or returning to work employees to the state of ohio within 20 days of hire or rehire date. Employers are required to submit their ein, corporate name, and address, as well as the new hire’s full Web form jfs 07048, ohio new hire reporting, is a formal statement used by ohio private and public employers to inform the government about the individual recently hired by their business. Info on how to report new hires and changes in employee status.