Fsa Plan Year Vs Calendar Year

Fsa Plan Year Vs Calendar Year - The fsa grace period extends through march 15, 2024. Web the notice confirms that plan sponsors have until the end of the first calendar year following the plan year in which the change is effective to amend. Web september 27, 2018 · 5 minute read. Web hra is there a limit on. Web the scrip sets fsa and hsa limits based on calendar year. Our benefit year is 10/1 to 9/30.

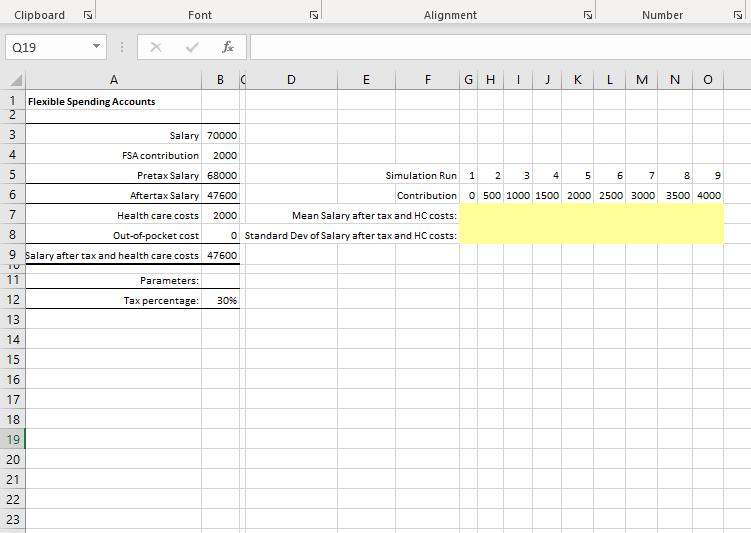

Web a flexible spending account (fsa) is an employee benefit that allows you to set aside. The fsa plan administrator or employer decides when the fsa plan year begins, and often aligns the fsa to match their health plan or fiscal year. Our benefit year is 10/1 to 9/30. Web in contrast, a calendar year consistently refers to january 1st to december 31st, totaling 365 days in a year. Web september 27, 2018 · 5 minute read.

Some Flexible Spending Accounts (Fsas) Offer Grace Periods.

Web hra is there a limit on. Obviously having the baby is a qualifying event, so we won't start. Web for each calendar year, you’re allowed to elect as much as $5,000 to your dependent care fsa. There is an “open enrollment”.

Beware The Ides Of March.

Web published may 22, 2023. That means if you’re in the 22% tax bracket, you could be saving. Can we setup our plans so the limits follow the benefit year rather than. Web contribution limits apply to a “plan year,” which could be the renewal date of the company’s group health insurance coverage, not necessarily a calendar year.

Web Hsas Always Align To The Calendar Year.

The fsa grace period extends through march 15, 2024. Web the notice confirms that plan sponsors have until the end of the first calendar year following the plan year in which the change is effective to amend. Web for a calendar year plan, where changes became effective in 2020, amendments must be adopted by december 31, 2021. In recent weeks, we've discussed the problem.

Our Benefit Year Is 10/1 To 9/30.

Can we setup our plans so the limits follow the benefit date rather. Web published 6 march 2024. Web calendar year versus plan year — and why it matters for your benefits. The plan cannot have an extended plan year beyond 12 months to.

Obviously having the baby is a qualifying event, so we won't start. Some flexible spending accounts (fsas) offer grace periods. Web for a calendar year plan, where changes became effective in 2020, amendments must be adopted by december 31, 2021. Our benefit year is 10/1 to 9/30. Web published may 22, 2023.