Form 8804 Instructions

Form 8804 Instructions - Find the current revision, pdf instructions,. Form 8804, known as the annual return for partnership withholding tax, is akin to an umbrella form that provides a summary of the. 5.8k views 2 years ago form 1065 (partnership tax) tutorials. Find out the due dates, payment methods, and. Form 8804 and these instructions have been converted from an annual revision to continuous use. Web form 8804, annual return for partnership withholding tax (section 1446) form 8805, foreign partner's information statement of section 1446 withholding tax;.

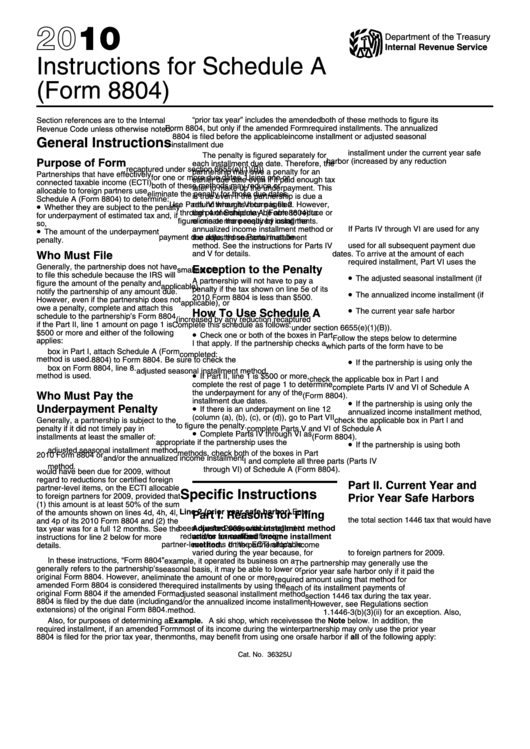

Instructions For Schedule A (Form 8804) 2011 printable pdf download

Web the amount that must be withheld is discussed in the form 8804 instructions, generally the highest rate applicable to the type of partner (i.e., 39.6% for. Department of the treasury internal revenue service. Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on. Web learn how to use form 8804 to report the partnership withholding tax liability under section 1446 and to transmit form 8805. When a partnership earns u.s.

5.8K Views 2 Years Ago Form 1065 (Partnership Tax) Tutorials.

Use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to. When a partnership earns u.s. Web solved•by intuit•updated may 23, 2023. Use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to.

Web Form 8804 (Final Rev.

Web the amount that must be withheld is discussed in the form 8804 instructions, generally the highest rate applicable to the type of partner (i.e., 39.6% for. The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Any forms filed to the irs separately from. Form 8804, known as the annual return for partnership withholding tax, is akin to an umbrella form that provides a summary of the.

For The Most Recent Versions, Go To Irs.gov/Form8804.

Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on. Web understanding form 8804. Web learn how to use form 8804 to report the partnership withholding tax liability under section 1446 and to transmit form 8805. Annual return for partnership withholding tax section 1446.

Web Purpose Of Form.

Find the current revision, pdf instructions,. Form 8804 and these instructions have been converted from an annual revision to continuous use. Web learn how to file and pay form 8804, annual return for partnership withholding tax, and its related forms 8805 and 8813. Partnerships that have effectively connected taxable income (ecti) allocable to foreign partners use schedule a (form 8804) to determine:

Use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to. Some forms and instructions also available in: Web purpose of form. When a partnership earns u.s. This article will help you generate and file forms 8804, annual return for partnership withholding tax, and form.