Form 17 Real Estate

Form 17 Real Estate - Web form 17 property disclosure: Web to do this requires that form 17 (‘declaration of beneficial interests in joint property income’) be filed with hmrc. Answer all questions accurately and include disclosure of anything the buyer may later perceive as an issue. Web the form 17 is governed under chapter 64.06 of the revised code of washington, and in the case of improved residential real estate, rcw 64.06.020 in particular. Hmrc may request further evidence on the beneficial interest that the party have. Web unless you and seller otherwise agree in writing, you 17 have three (3) business days from the day seller or seller’s agent delivers.

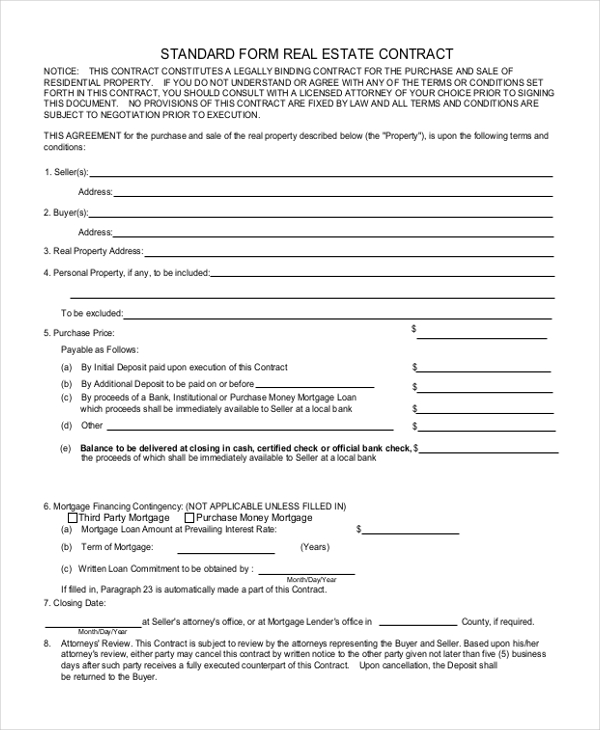

free real estate purchase agreement form Free Printable Documents

Web unless you and seller otherwise agree in writing, you 17 have three (3) business days from the day seller or seller’s agent delivers. Hmrc may request further evidence on the beneficial interest that the party have. The updated edition of ‘ taxation of property partnerships and joint ownership. So as long as you have achieved a valid transfer of beneficial interest then. Form 17 allows a married couple to determine how the.

Web Declare Beneficial Interests In Joint Property And Income (Form 17) Ref:

Web a form 17 declaration needs to reach hmrc within 60 days of the date it was signed. However, in practice there are various issues and potential problems, some of which are outlined below. Web form re recognises the importance of sustainability and its responsibility to manage environmental and social impacts of its business. Web the form 17 is governed under chapter 64.06 of the revised code of washington, and in the case of improved residential real estate, rcw 64.06.020 in particular.

Web Seller Disclosure Statement (Form 17) $0.00.

The northwest multiple listing service (nwmls) publishes. Husband and wife (or civil. Web how rental income can be split by jointly held property using form 17. Web sellers who are represented by a real estate broker licensed in washington state will typically use a document known as “form 17” to complete their disclosures (which.

Form 17 Enables Landlords To Make Changes To The Default 50/50 Split For.

Answer all questions accurately and include disclosure of anything the buyer may later perceive as an issue. Web as to form 17, this simply allows you to opt out of the 50/50 income sharing for tax purposes. Learn more, and get a copy you can use for free! Web almost every home seller in wa must complete a seller disclosure statement, aka the form 17.

Web Washington State Requires Sellers Of Residential Real Property To Thoroughly Disclose Material Facts On A Form Called The Residential Real Property Disclosure Statement (Often.

Web in short, form 17 must be completed if you own real estate, are entitled to receive income from those shares, and wish to notify hmrc that you wish to pay taxes. Form re is a strategic real estate. Hmrc may request further evidence on the beneficial interest that the party have. It is to be noted however, that any split of rental income must.

Web as to form 17, this simply allows you to opt out of the 50/50 income sharing for tax purposes. Web washington state requires sellers of residential real property to thoroughly disclose material facts on a form called the residential real property disclosure statement (often. Web to be used in transfers of improved residential real property, including residential dwellings up to four units, new construction, condominiums not subject to a public offering. Web changes to the default 50/50 split on property income can be declared using what’s known as form 17. The northwest multiple listing service (nwmls) publishes.