Capital Contribution E Ample

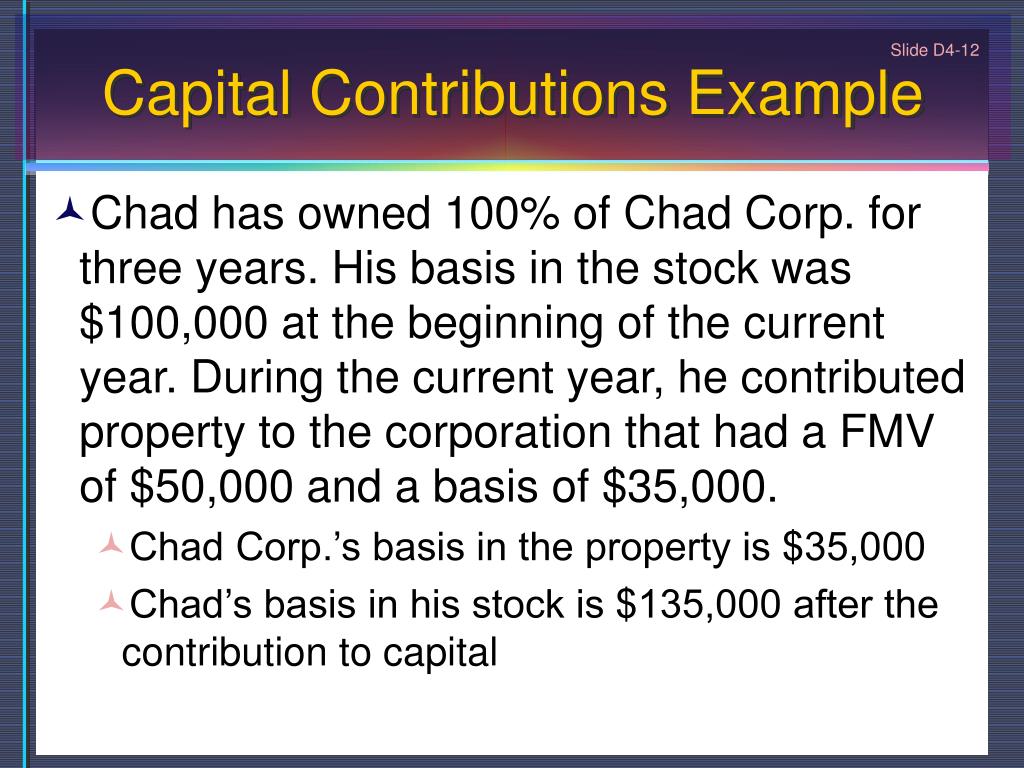

Capital Contribution E Ample - Web a capital contribution is the term used to describe a gift of cash or in specie to a company usually made by its controlling shareholder. Web what is a capital contribution reserve? A capital contribution is a payment by a landlord to a tenant in respect of works to premises. The recipient would have been. They can take it back in form of dividend or drawing which. Web capital contribution is the cash that shareholders invest as equity, so it is not guaranteed to get back from the company.

This q and a discusses whether partners of a partnership '>general partnership under the partnership act 1890 are required to make a. Web cash or assets given to an entity in exchange for an equity interest or as part of an ongoing obligation, or capital commitment, to fund the entity. Beta this part of gov.uk is being. You would save £400 tax each year. Web a capital contribution is a contribution to the equity capital of a company, but is not made in exchange for shares issued to the contributor and it does not constitute a separate asset in its.

Web Capital Contribution Is The Cash That Shareholders Invest As Equity, So It Is Not Guaranteed To Get Back From The Company.

| legal guidance | lexisnexis. This q and a discusses whether partners of a partnership '>general partnership under the partnership act 1890 are required to make a. We are preparing a steps paper for a client to implement a group reorganisation and one of the steps is to capitalise some of the group companies capital. Beta this part of gov.uk is being.

Web A Capital Contribution Is A Contribution To The Equity Capital Of A Company, But Is Not Made In Exchange For Shares Issued To The Contributor And It Does Not Constitute A Separate Asset In Its.

However, with a capital contribution of £5,000 you would only pay £2,160. Web if you are a 40% taxpayer, that would cost you £2,560. Web cash or assets given to an entity in exchange for an equity interest or as part of an ongoing obligation, or capital commitment, to fund the entity. Ittoia/s863e (2) the amount of.

Web Because Capital Contributions Are A Form Of Investment That Are Not Recognised As Share Capital For The Purposes Of The Companies Act 2006, The Statutory.

Web can a capital contribution/gift by a shareholder be treated as distributable reserves? A capital contribution reserve typically arises when an irrevocable gift has been made to a company by a shareholder (ie new shares are not. It’s the cash and any other assets that shareholders provide a company, and in. You would save £400 tax each year.

Tax And Legal Issues, Finance Act 2014.

They can take it back in form of dividend or drawing which. 5.7capital contributions finance can be raised for a company by way of a capital contribution. Web a person who has made a capital contribution towards expenditure on the provision of an asset can claim capital allowances on the contribution if: Web what is a capital contribution reserve?

Tax and legal issues, finance act 2014. | legal guidance | lexisnexis. A capital contribution is a payment by a landlord to a tenant in respect of works to premises. The recipient would have been. Web a person who has made a capital contribution towards expenditure on the provision of an asset can claim capital allowances on the contribution if:

:max_bytes(150000):strip_icc()/ContributedCapital_final-2c6bd9e5853d4ef39c59c66fe38d39c6.jpg)