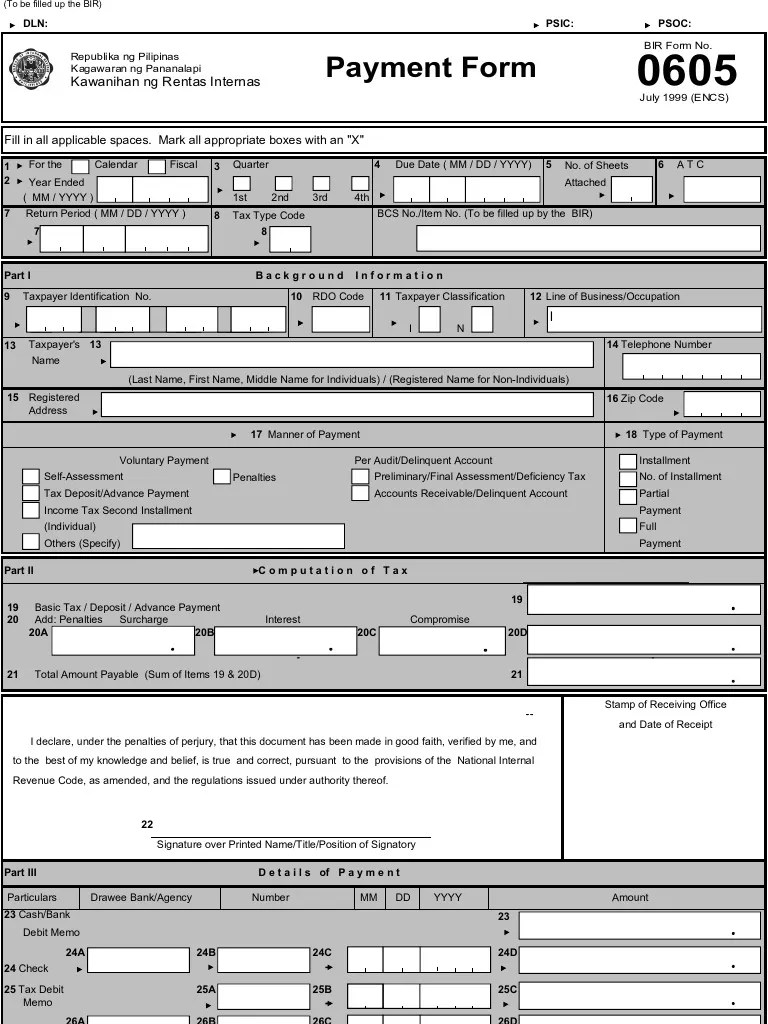

Bir Form 0605

Bir Form 0605 - Put rf (registration fee) under the tax type code. Web all ngas shall use bir form no. It (to be filled up the bir). Web bir form 0605 is the official payment form. Web the bir form 0605 is a form for payment of registration fees, penalties, and other fees due to the bir. Fill out the necessary details.

These colored white text fields or option buttons are used to enter data. Web the bir form 0605 is a form for payment of registration fees, penalties, and other fees due to the bir. Web list of bir forms. Web bir form 0605 is a tax return for paying the annual registration fee of php 500.00 for all registered taxpayers, except those earning compensation income. Web efps option page for form 0605.

Web All Ngas Shall Use Bir Form No.

Business taxpayers can keep their. Web bir annual registration fee is worth five hundred pesos (p500) each new year. There are two methods in completing a tax form for submission in the efps: Put rf (registration fee) under the tax type code.

Every Taxpayer Shall Use This Form, In Triplicate, To Pay Taxes And Fees Which Do Not Require The Use Of A Tax Return Such As Second Installment Payment For Income Tax,.

Web this comprehensive guide will walk you through the bir 0605 form, your ultimate tool for simplifying tax payments. Web bir form 0605 is the official payment form. Web list of bir forms. These colored white text fields or option buttons are used to enter data.

Web The Bir Form 0605 Is A Form For Payment Of Registration Fees, Penalties, And Other Fees Due To The Bir.

Web efps option page for form 0605. Web procedures in accomplishing the bir form no. Web the bir will stop collecting the annual registration fee (arf) and the need to file bir form no. 0605 in the filing and remittance of abovementioned withholding taxes thru the electronic filing and payment system ( efps).

It (To Be Filled Up The Bir).

The bir form 0605 is to be. 0605 effective january 22, 2024. Whether you’re a business owner or an. Web bir form 0605 is a form that taxpayers need to fill out when they pay taxes and fees that don't require tax returns, such as secondary installment payment, deficiency tax,.

Failure to file, pay and display bir form 0605 annual registration fee will result to a compromise. July 1999 (encs) payment form. Web bir form 0605 is a tax return for paying the annual registration fee of php 500.00 for all registered taxpayers, except those earning compensation income. Web efps option page for form 0605. Web the bir will stop collecting the annual registration fee (arf) and the need to file bir form no.